How To Write a Demand Letter for a Car Accident Settlement in Texas (with Examples)

December 18, 2023

Today you’re going to learn how to write a personal injury demand letter for a car accident settlement in Texas.

And the tips in this article actually work.

In fact, the example demand letter below resulted in a $25,000 settlement offer from the at-fault driver’s insurance company:

In this article, we’ll look at each section of a demand letter from one of my actual personal-injury cases. I’ll highlight key elements to include in your own demand letter.

Here is an overview of this article:

- 1. Letterhead Information

- 2. Recipient and Claim Information

- 3. Factual Background Section

- 4. Visual Aids

- 5. Description of At-Fault Driver’s Negligence

- 6. Property Damage Photos

- 7. Injury Photos

- 8. Liability Section

- 9. Traffic Safety Statute Violations

- 10. Medical Treatment and Expenses

- 11. At-Fault Driver’s Exposure

- 12. Insurance Company’s Exposure

- 13. Offer of Settlement and Full Release

- 14. Demand for Preservation of Evidence

- 15. Documents to Send with Your Demand Letter

- Other Sections to Consider Adding to Your Demand Letter

- Conclusion

Here is the first page of my sample demand letter:

1. Letterhead Information

The letterhead section of your demand letter is more than a formality. It plays an important role in establishing a professional line of communication with the at-fault driver’s insurance company.

Here’s what to focus on:

Return Receipt Number

- Purpose: Acts as a tracking and confirmation tool for your letter’s delivery, vital for validating receipt by the insurance company.

- Method: Send your letter via Certified US Mail with signature confirmation and include the return receipt number at the top of your letter.

Your Contact Information

- Significance: It’s crucial for the insurance adjuster to reach out to you, potentially speeding up the negotiation process.

- Details: Ensure you provide your full name, address, phone number, and email address.

Date of Mailing

- Relevance: The mailing date is key in establishing a timeline for your claim, helping to track the insurance company’s response period and acknowledging your demand.

This initial section, while brief, sets the tone for your entire claim. It’s about being precise, professional, and prepared for the ensuing negotiation and potential legal proceedings.

2. Recipient and Claim Information

Ensuring your demand letter reaches the correct person at the insurance company is crucial for a timely settlement of your car accident claim in Texas.

Here are direct, essential steps to follow:

Identifying the Right Recipient

- Key Action: The demand letter must be sent to the at-fault driver’s insurance company. This is your primary contact for the claim.

Gathering Adjuster Information

- Initial Step: Call the insurance company to report the claim. You can find the insurance company’s phone number and the insured’s policy number on the at-fault driver’s Proof of Insurance card or the Crash Report.

- Information to Obtain: Get the bodily injury adjuster’s full name, email, phone number, fax number, and mailing address.

Filing a Claim

- If No Claim Yet: Provide the at-fault driver’s full name, policy number (found on their insurance card), and any crash report details.

- Crucial Details: Obtain the claim number and confirm the at-fault driver’s name spelling.

Communicating with the Adjuster

- Be Cautious: Remember, the adjuster’s job is to minimize the company’s payout. Be mindful of what you say.

- Limit Information: If asked about the accident, injuries, or treatments, politely defer to the information in your demand letter. Avoid detailed discussions over the phone.

Avoid Recorded Statements

- Best Practice: Generally, it’s advisable not to give a recorded statement. These are often used to find reasons to deny claims.

- Remember: Giving a recorded statement is more likely to harm than help your claim.

Navigating this process requires a balance of thoroughness and caution. By methodically gathering and providing information, and being aware of the adjuster’s motives, you can set a solid foundation for your claim.

3. Factual Background Section

In crafting your personal injury demand letter for a car accident settlement in Texas, the Factual Background Section is where you lay the groundwork of your claim. This section is your opportunity to provide a clear, concise, and factual narrative of the events.

Here are some tips for writing it:

The Importance of Facts

- Objective: Deliver a straightforward account of the incident without any exaggeration or personal opinions.

- Approach: Stick to the facts – who, what, when, where, why, and how.

Using the Crash Report

- If Available: Leverage the officer’s narrative from the crash report if it accurately describes the accident and fault.

- Advantage: This provides an official and unbiased account of the incident.

Crafting the Narrative Without a Crash Report

- Date and Time: Note the exact date and approximate time of the accident.

- Location Details: Mention the city and specific street where the accident occurred.

- Vehicle Information: Include the year, make, and model of each vehicle involved.

- People Involved: List the full names of all drivers and passengers in the accident.

- Road Conditions: Describe the number of lanes and specify which lane each vehicle was in at the time of the accident.

- Collision Details: Identify which vehicle hit you and the points of impact on both vehicles.

- At-Fault Actions: Clearly state what the at-fault driver did wrong to cause the accident.

- Witness Statements: When possible, have eyewitnesses write a statement describing what they saw and who caused the accident. This can tip the scales in your favor, especially if you don’t have a Crash Report or the Crash Report is inaccurate.

Remember, accuracy and detail are key in this section. It forms the basis of your entire claim, particularly if there’s no crash report. Your description here will shape the adjuster’s understanding of the incident.

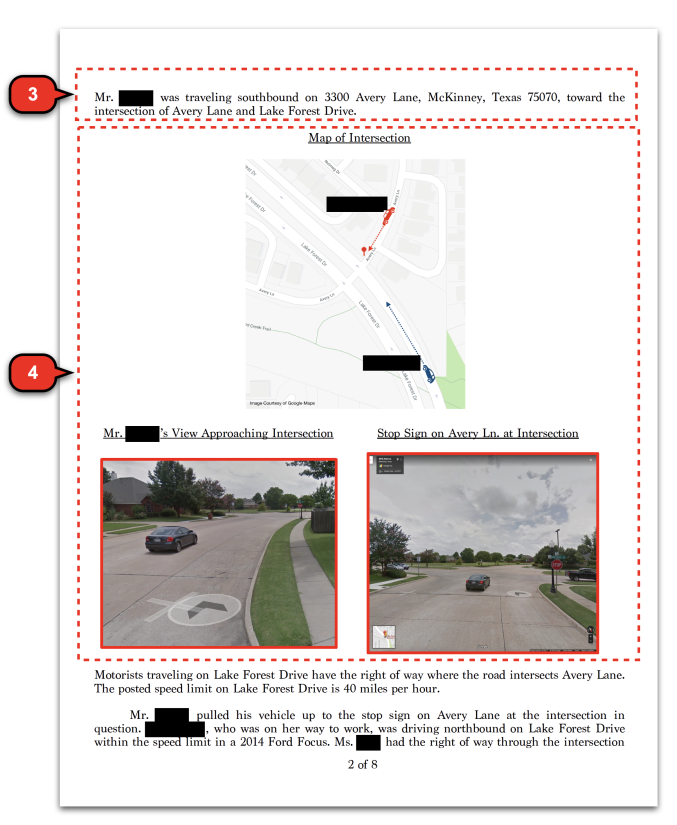

4. Visual Aids

“A picture is worth a thousand words,” especially in the context of a personal injury demand letter after a car crash in Texas.

Visual aids are pivotal in reinforcing your case, providing a vivid and impactful depiction of the crash scene that often speaks louder than written descriptions.

Here’s a guide on utilizing them effectively:

Using Diagrams and Maps

- Intersection Diagram: Like in the example demand letter, use a diagram to depict the direction of the vehicles and the point of impact. This can clarify how the at-fault driver violated your right of way.

- Google Maps and Street View: Employ these tools to provide real-life images of the intersection. Highlight key elements like stop signs, traffic lights, and road markings.

- Real-Life Example: In the example demand letter above, I used Google Street View images to show that my client clearly had the right of way. I also used Google Street View images to show that the at-fault driver should have seen my client’s vehicle coming his direction while he was stopped at the stop sign.

Examples of Effective Visual Aids

- Dashcam Footage: If available, it provides a real-time account of the accident.

- Surveillance Videos: Footage from nearby businesses or traffic cameras can offer an external perspective of the incident.

- Witness Sketches: Sometimes, witnesses can provide sketches that give a different viewpoint of the accident.

- Aftermath Scene Photos: Images of the accident scene, excluding the vehicles, can show skid marks, debris, or damage to surroundings, which help in piecing together the events.

- Documented Road Conditions: Photos or videos showcasing the weather or road conditions at the time of the accident can be relevant, especially if they contributed to the incident.

Effectiveness of Visual Aids

- Clarity and Context: They bring the written words to life, offering a clearer understanding of the accident.

- Supporting the Narrative: Visual aids corroborate your description of the accident, reinforcing the liability aspect.

- Enhancing Credibility: They provide tangible proof to back up your claims, making your case more convincing.

Incorporating these visual elements into your demand letter can significantly enhance its effectiveness. They not only assist in explaining the accident but also serve as indisputable evidence that supports your claims.

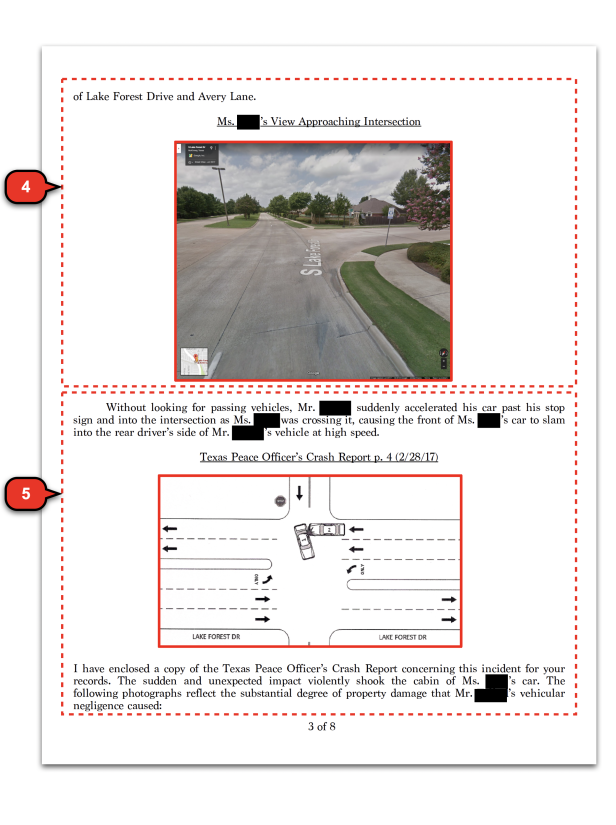

5. Description of At-Fault Driver’s Negligence

In your personal injury demand letter, detailing the at-fault driver’s negligence is a critical component. This section should unequivocally establish their fault in the accident. It’s essential to be factual and precise, as this forms the basis for your claim of negligence. Here’s what to include:

Fact-Based Explanation

- Objective: Clearly state how the at-fault driver’s actions led to the accident.

- Approach: Stick to the facts without any emotional language or personal opinions.

Specific Acts or Omissions Leading to the Accident

- Common Scenarios: Include specific behaviors like running a red light, tailgating, speeding, distracted driving, failure to keep a proper lookout, or failure to yield right of way.

- Correlation: Explain how these actions directly caused the accident.

- Example: In the above example demand letter, I explain how the at-fault driver suddenly pulled past the stop sign and entered the intersection without looking, causing the front of my client’s car to slam into the rear driver’s side of his vehicle. This is consistent with the points of impact shown in the property damage photos.

Eyewitness Accounts

- Inclusion: If there are any eyewitness accounts, summarize their statements to support your claim of negligence.

- Reliability: Highlight the credibility of these witnesses and how their perspective corroborates your account.

Additional Evidence

- Relevant Evidence: Include any other forms of evidence that support the claim of negligence, like the crash report diagram, dashcam footage, or surveillance videos.

- Example: In the above example demand letter, I used a screenshot of the diagram in the crash report to show the adjuster how the at-fault driver suddenly pulled out in front of my client’s vehicle.

This section is where you describe the at-fault driver’s carelessness and how it caused your collision. Try not to argue your case. Instead, dispassionately describe what happened.

The more your photos, points of impact, and other evidence align with your narrative of the events, the stronger your case becomes in convincing the adjuster that their insured is at fault.

Now let’s look at how you can use property damage photos to support your claim:

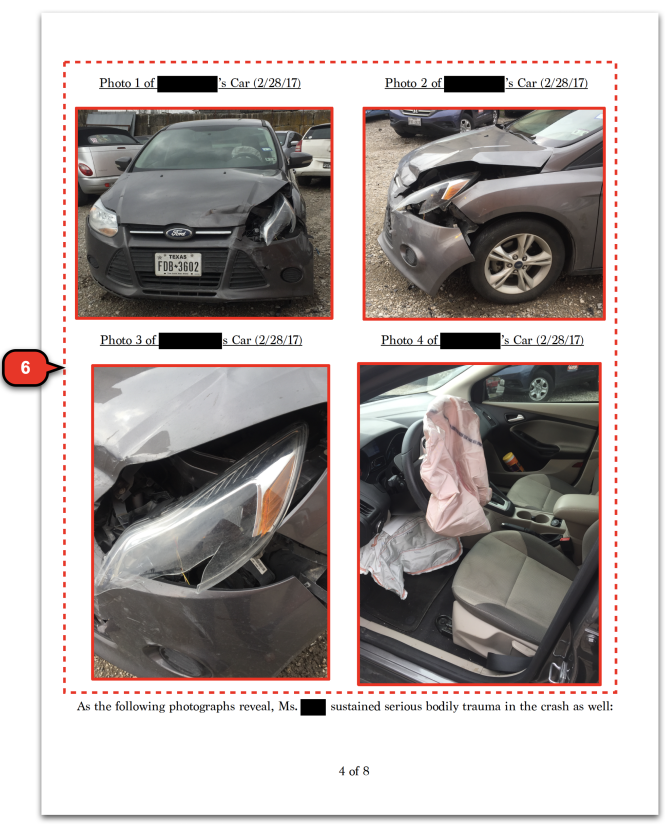

6. Property Damage Photos

In the context of a car accident settlement demand, using property damage photos in your demand letter can support your claim. These photos can visually demonstrate the severity of the collision and substantiate your narrative.

Here’s how to effectively use them:

Types of Photos to Include

- Your Vehicle: Show all areas of your car that were damaged.

- Other Driver’s Vehicle: Capture the damage on the at-fault driver’s car.

- Road Debris: Include any debris or wreckage on the road resulting from the accident.

- Surrounding Damage: Document any damage to traffic lights, road signs, or other structures.

Demonstrating Impact Severity

- Importance: High levels of visible damage can imply a significant force of impact, making it more plausible for you to have sustained serious injuries.

- Purpose: These photos can make it easier for the adjuster to understand the potential for severe injury, even in the absence of extensive medical reports.

Corroborating Collision Details

- Points of Impact: Property damage can help establish the points of impact, which corroborates the nature of your injuries and the dynamics of the accident.

- Recreating the Incident: The damage pattern can assist in reconstructing the events leading to the collision, clarifying liability.

Assessing the Relevance of Property Damage

- Severity vs. Injuries: Remember, the severity of certain injuries, like soft tissue damage, doesn’t always correlate with the extent of property damage.

- Strategic Inclusion: If the property damage doesn’t underscore the seriousness of the wreck or your injuries, consider omitting these photos from your letter.

Property damage photos are more than just evidence of a car wreck; they are visual storytellers that can add weight to your claim. They not only show the physical aftermath of the accident, but also support your account of how the incident occurred and the extent of the impact.

7. Injury Photos

In your personal injury demand letter, including photos of your injuries can be a powerful tool in demonstrating the severity and impact of the car accident. These visual representations can convey the extent of your suffering more effectively than words alone. Here’s how to include them strategically:

Choosing the Right Photos

- Focus on Severity: Select photos that clearly show the seriousness of your injuries. This could include bruises, cuts, casts, or any medical equipment used.

- Chronological Order: If possible, arrange the photos in a sequence that shows the progression of your injuries. This helps in painting a clear picture of your recovery process.

Correlating Injuries with the Accident

- Direct Link: Use the photos to establish a direct connection between the injuries and the accident. Ensure they reflect the type of injuries one would expect from such a collision.

- Supporting Medical Reports: Pair your injury photos with corresponding medical reports for a more comprehensive presentation of your injuries.

- Example Demand Letter:

- In the above example, the injury photos show seatbelt burns. As my client’s body was thrust forward when at the moment of impact, her seatbelt locked in place, causing visible burns and cuts across her chest. These photos capture the violent force of the impact.

- Though these surface scrapes healed within weeks, they highlighted the severity of the collision’s impact. While depicting less severe injuries, these photos substantiated my client’s more serious soft-tissue injuries.

The Impact of Injury Photos

- Emotional Appeal: These photos can create an emotional impact, making it harder for the insurance adjuster to downplay your injuries.

- Strengthening Your Claim: They provide tangible evidence of your pain and suffering, supporting your claim for compensation.

Injury photos are not just about showing the physical wounds; they are about illustrating the pain and challenges you have faced since the accident. When used effectively, they become an undeniable testament to your experience and a compelling argument for a just settlement.

8. Liability Section

The liability section is a pivotal part of your personal injury demand letter. It’s here that you clearly establish how the at-fault driver’s actions not only caused the accident but also breached the standard of care required by all drivers. This breach is the legal foundation of your claim. Below are key points often used to assert a driver’s liability:

Duty of Care Violations

Every driver has a duty to operate their vehicle safely and responsibly. Your insured breached this duty by:

- Failing to Maintain a Safe Distance: Not keeping an adequate buffer between vehicles.

- Not Controlling Vehicle Speed: Driving either too fast or too slow for the conditions.

- Lack of Proper Lookout: Not being adequately aware of their surroundings.

- Delayed Braking: Not applying brakes in time to prevent a collision.

- Ignoring Stop Signs: Failing to stop and check for oncoming traffic.

- Disobeying Traffic Signals: Ignoring lights or other traffic control devices.

- Not Yielding Right of Way: Failing to give way to those who have the priority.

- Running Red Lights: Proceeding through intersections illegally.

- Speed Limit Violations: Exceeding or not adhering to posted speed limits.

- Neglecting to Signal: Not indicating intentions to turn or change lanes.

- Careless Intersection Navigation: Not proceeding with caution from stop signs.

- General Unsafe Operation: Any other actions that compromise vehicle safety.

Establishing Liability

- Connection to Accident: Illustrate how each of these actions directly led to the collision.

- Legal Standards: Reference applicable Texas traffic laws to solidify your argument.

- Causation: Show that it was these specific breaches of duty that resulted in the accident and your subsequent injuries.

This section is designed to convincingly argue that the at-fault driver’s negligence and disregard for traffic laws and safety protocols directly led to the accident. By methodically outlining these points, you build a strong case for their liability.

9. Traffic Safety Statute Violations

In a Texas car accident claim, citing specific traffic safety statute violations is crucial. This section of your demand letter should parallel the liability section but with a focus on the actual rules of the road – traffic safety statutes – that the at-fault driver broke, causing the wreck. Texas law allows for recovery under “negligence per se,” a legal concept where violating a statute designed to protect people (like traffic laws) is considered inherently negligent. By including this section, you provide a concrete legal basis for your claim.

Understanding Negligence Per Se

- Definition: Negligence per se occurs when an individual violates a statute that causes harm to a class of persons that the statute was designed to protect.

- Importance in Demand Letters: Highlighting these violations directly links the at-fault driver’s actions to their legal negligence, strengthening your claim.

Texas Traffic Safety Statutes

In my experience, drivers who are responsible for causing wrecks in Texas have usually violated one or more of the following rules of the road:

- Safe Following Distance: Requires drivers to maintain a safe distance from other vehicles (Tex. Transp. Code § 545.062(a)).

- Stop Sign Compliance: Obligates drivers to stop at stop signs (Tex. Transp. Code § 544.010(a)).

- Reckless Driving Prohibition: Prohibits reckless driving behavior (Tex. Transp. Code § 545.401(a)).

- Red Light Compliance: Mandates drivers to stop at red lights (Tex. Transp. Code § 544.007(d)).

- Speed Regulation: Prohibits driving at an unsafe speed (Tex. Transp. Code § 545.351).

- Intersection Safety: Requires drivers to enter intersections safely without causing interference or collision (Tex. Transp. Code § 545.151(a)(2), (f)).

- Lane Change Safety: Prohibits unsafe lane changes (Tex. Transp. Code § 545.060(a)).

- Safe Turning: Requires safe execution of turns (Tex. Transp. Code § 545.103).

- Turn Signal Requirement: Obligates drivers to signal before changing lanes (Tex. Transp. Code § 545.104).

- Information Exchange Post-Accident: Requires drivers involved in a wreck to provide contact and insurance information to injured parties (Tex. Transp. Code § 550.023).

- Speeding Prohibition: Prohibits exceeding speed limits (Tex. Transp. Code § 545.352(a)).

- Texting and Driving Ban: Prohibits texting while driving (Tex. Transp. Code § 545.4251(b)).

Linking these statutes to the corresponding sections of the Texas Transportation Code provides legal grounding for each claim of negligence.

In this section, you’re not just arguing that the at-fault driver was careless; you’re demonstrating that their actions were legally negligent, bolstering your argument for liability and damages.

Next, let’s examine how to write an effective section about your medical treatment and expenses.

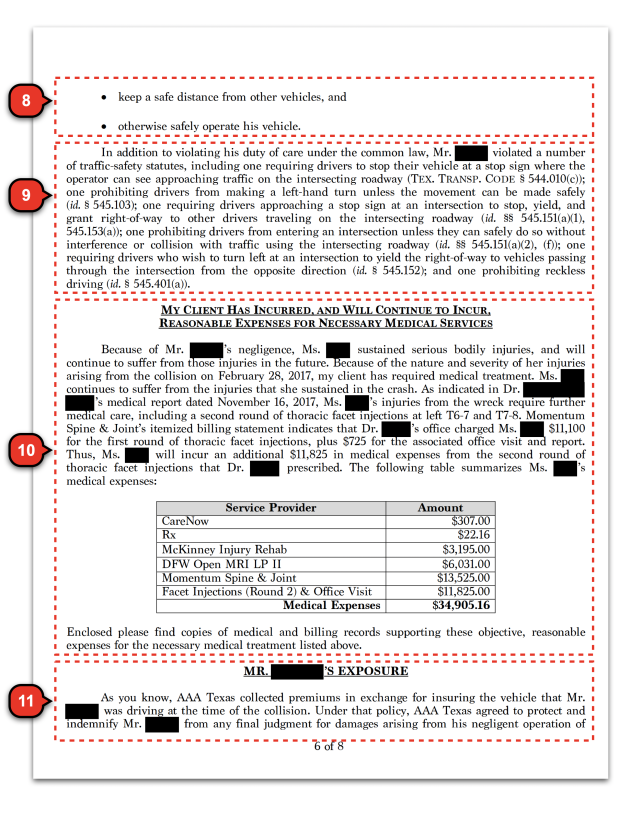

10. Medical Treatment and Expenses

In personal injury cases stemming from car accidents, the presentation of medical treatment and expenses in your demand letter can significantly influence the settlement process. The approach varies depending on the scale of the case.

Approach in Smaller Cases

- Medical Expenses Under $40,000: For cases where medical expenses are relatively low, a detailed description of injuries and treatments isn’t necessary.

- Records Sufficiency: As suggested by Miller & Zois, the medical records in such cases are self-explanatory. Over-elaborating can appear amateurish.

Strategy in Larger Cases

- Significant Expenses or Commercial Vehicle Involvement: Here, a chronological and detailed account of injuries and treatments is crucial.

- Objective: The aim is to streamline the adjuster’s review process, facilitating their ability to secure higher settlement authorization.

- Focus on Future Treatments: Highlight any recommended future treatments, including their costs, whether you plan to pursue them or if they are contingent on insurance coverage.

Presenting Medical Expenses

- Expense Table: After detailing your medical treatment, create a table listing each medical provider and any out-of-pocket prescriptions.

- Expense Breakdown: Next to each provider, include total expenses paid by you, covered by others, or still owed.

- Inclusion of Health Insurance Payments: If health insurance covered part of your medical bills, those payments should also be listed. This is important because your health insurer has a right to be reimbursed from any settlement funds.

Importance of a Comprehensive Overview

- Clarity and Transparency: This section should clearly outline the financial impact of the accident on your health and pocket.

- Legitimacy and Justification: Detailed and accurate presentation of medical expenses justifies the compensation you are seeking.

- Adjuster’s Ease: By organizing this information efficiently, you make it easier for the adjuster to assess and justify the settlement amount.

In essence, the way you present your medical treatment and expenses can greatly impact the adjuster’s perception and response to your demand. In smaller cases, let the records speak for themselves. In larger cases, a detailed, chronological account helps paint a clearer picture of your suffering and financial burden, paving the way for a more favorable settlement.

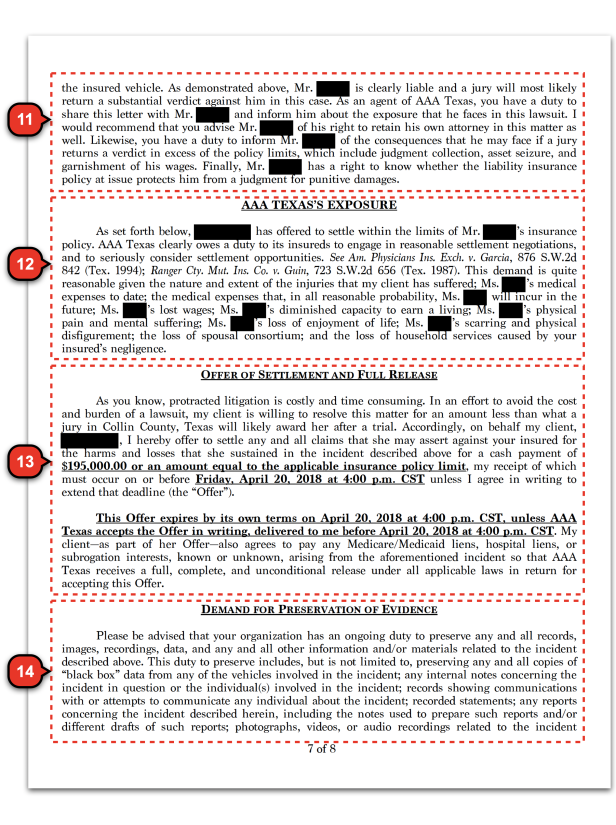

11. At-Fault Driver’s Exposure

In your personal injury demand letter, addressing the at-fault driver’s exposure is a strategic move that can influence the settlement process. This section not only highlights the driver’s potential liabilities but also serves to apply pressure on the insurance adjuster to seriously consider your settlement offer. Here’s a breakdown of the key elements and their significance:

Insurance Obligations and Premiums

- Insurance Coverage: Start by reminding the insurance company of their agreement to protect their client from damages due to negligent operation of the vehicle.

- Purpose: This serves to remind the adjuster of the contractual and financial responsibilities the insurance company has towards their insured.

Liability and Potential Jury Verdict

- Establishing Clear Liability: Assert that the insured is clearly liable, based on the evidence presented earlier in your letter.

- Jury Verdict Warning: Suggest that a jury is likely to return a substantial verdict against the insured.

- Effect: This implies the risk of a high payout, encouraging the insurance company to settle rather than risk a jury trial.

Duty to Inform the Insured

- Advisory Role: Highlight that the adjuster has a duty to inform their insured about the potential exposure and risks involved in the lawsuit.

- Independent Legal Counsel: Suggest that they advise their insured of the right to seek independent legal counsel. This underscores the seriousness of the situation to the insured, potentially influencing them to urge their insurer to settle.

- Consequences of a Jury Verdict: Emphasize the potential personal financial consequences to the insured, such as asset seizure or wage garnishment, if a verdict exceeds their policy limits.

- Punitive Damages: Question whether their policy covers punitive damages.

- Purpose: This puts pressure on the insurance adjuster to settle the claim within policy limits to protect their insured from personal financial risk.

Strategic Impact

- Pressure Application: Each of these points is designed to apply pressure on the insurance adjuster by highlighting the serious financial and legal risks to their insured.

- Encouraging Settlement: By clearly outlining the potential negative outcomes for the insured, the insurance company is more likely to consider settling within the policy limits to avoid further complications.

This section of your demand letter plays a crucial role in the negotiation process. By effectively communicating the at-fault driver’s exposure, you not only demonstrate a strong understanding of the legal implications but also strategically encourage the insurance company to accept your settlement offer.

12. Insurance Company’s Exposure

In this section of your demand letter, we focus on the insurance company’s exposure. This is a key aspect in negotiating a fair settlement, as it highlights the potential risks and costs the insurance company may face if the case goes to trial.

Understanding and articulating these risks can be a compelling factor in persuading the insurance company to settle within the policy limits.

The Risk of a Jury Verdict

- Potential for High Awards: Emphasize the possibility of a jury awarding a large sum, possibly exceeding the policy limits. This is especially relevant given the details and evidence of negligence you’ve provided.

- Cost of Litigation: Remind the insurance company of the significant expenses associated with taking a case to trial, including attorney fees, court costs, and the unpredictability of jury decisions.

Legal Precedents and Obligations

- Referencing Key Cases: Cite legal precedents that highlight the insurer’s obligation to act in good faith and avoid exposing their insured to undue financial risk.

- Duty to Settle Within Policy Limits: Stress that failing to settle within policy limits, when a reasonable offer is made, can result in the insurer being liable for the entire judgment amount, even if it exceeds policy limits.

The Stowers Doctrine

- Application: Explain how the Stowers Doctrine in Texas law obligates insurers to accept reasonable settlement demands within policy limits to protect their insured from excess judgments.

- Implications: Failing to adhere to this doctrine can lead to the insurance company being held responsible for the full amount awarded, which could significantly exceed the policy limits.

Strategic Settlement Consideration

- Cost-Benefit Analysis: Urge the insurance company to perform a cost-benefit analysis, considering the potential financial repercussions of not settling.

- Encouraging Early Settlement: Point out the benefits of an early settlement, including reduced legal costs and mitigating the risk of a large jury verdict.

Key Cases

In discussing the insurance company’s exposure in personal injury cases, it’s crucial to reference the legal precedents set by American Physicians Insurance Exchange v. Garcia, 876 S.W.2d 842 (Tex. 1994) and Ranger County Mutual Insurance Co. v. Guin, 723 S.W.2d 656 (Tex. 1987). These cases provide vital insights into the obligations and risks faced by insurers in settlement negotiations.

Garcia’s Interpretation of an Insurance Company’s Stowers Duty

- Settlement Demand Requirements: For a settlement demand to trigger an insurance company’s Stowers duty, it must offer to fully release the insured in exchange for “an amount equal to the applicable insurance policy limit.”

- Three Prerequisites for Triggering the Stowers Duty:

- The claim against the insured must be within the coverage scope.

- The demand must be within policy limits.

- The demand’s terms must be such that an ordinarily prudent insurer would accept it, considering the potential exposure to an excess judgment.

- Limitations: A demand above policy limits does not trigger the insurance company’s Stowers duty.

Ranger’s Duty of Ordinary Care

- Scope of Duty: Includes investigation, defense preparation, trial conduct, and reasonable settlement attempts.

- Case Example: In Ranger, the insurer was found negligent for not accepting a severable settlement demand within policy limits and for failing to inform its insureds of the demand terms.

- Hard Bargaining in Negotiations: While acknowledging that settlement negotiations are adversarial, Ranger affirmed that insurers still have a duty to accept reasonable demands within policy limits.

Implications for Insurance Companies

- Risk of Excess Judgment: Insurers face the risk of being responsible for the entire judgment amount if they fail to settle within policy limits when a reasonable offer is made.

- Subsidiary Factors: Evidence concerning claims investigation and defense is secondary to whether the demand was reasonable and should have been accepted by a prudent insurer.

- No Absolute Demand Requirement: While a formal demand is not always necessary for liability, the absence of a reasonable opportunity to settle within policy limits can lead to insurers bearing the risk of an excess judgment.

In summary, these legal precedents underscore the importance of insurers engaging in reasonable settlement negotiations and carefully considering settlement demands within policy limits. Failure to do so can result in significant financial liability for insurers, particularly if they miss a reasonable opportunity to prevent excess judgments.

13. Offer of Settlement and Full Release

This section of your demand letter is where you make a formal settlement offer to the insurance company, incorporating key elements to align with the Stowers doctrine, as outlined in the Garcia and Ranger cases. Here’s an analysis of the structure and strategic considerations of this offer:

Text from the Sample Demand Letter

- Settlement Offer: Proposes a resolution of $195,000.00 or an amount equal to the policy limit, whichever is less.

- Deadline for Acceptance: The offer is valid until a specific date and time, creating urgency.

- Complete Release: Includes the agreement to pay any liens arising from the incident, ensuring a full release for the insurance company.

Alignment with Stowers Doctrine

- Reasonable Amount Within Policy Limits: The offer is within a reasonable range that an insurer should be able to cover, adhering to the criteria of a Stowers demand.

- Clear Terms and Deadline: By setting a specific deadline and terms for acceptance, the offer meets the requirement of being clear and actionable for the insurer.

- Protection of Insured’s Interests: The full release provision aligns with the insurer’s duty to protect their insured from further liabilities.

Strategic Time Pressure

- 14-Day Response Window: A 14-day deadline is considered reasonable, allowing the insurance company adequate time to review the offer.

- Creating Urgency: The specific expiry time eliminates ambiguity and applies pressure on the adjuster to act promptly.

Settlement Amount Considerations

- Balancing Client’s Needs and Policy Limits: The offer is crafted to reflect the client’s damages and expectations while being mindful of unknown policy limits.

- Flexibility Based on Policy Limits: If actual policy limits are higher, the offer is advantageous for the insurer. If limits are lower, insurers tend to offer near the maximum policy limits.

- Real-Life Example: In the provided example, the insurer’s counteroffer was slightly below the policy limits, which was acceptable to the client, leading to a successful settlement.

This carefully crafted settlement offer is a crucial step in the negotiation process. It is designed to be reasonable and within potential policy limits, while also ensuring a full and final resolution of the claim. This strategic approach aims to expedite the settlement and avoid the need for protracted litigation.

14. Demand for Preservation of Evidence

In this section of your demand letter, you formally request the preservation of all relevant evidence pertaining to the incident. This is a crucial step to ensure that all potential evidence is retained and available for any subsequent legal proceedings. Here’s how to effectively articulate this demand:

Text from the Sample Demand Letter

- Preservation Duty: Clearly state the insurance company’s duty to preserve a broad range of materials related to the incident.

- Scope of Materials: This includes repair records, drug and alcohol test results, investigation reports, vehicle inspection documents, witness statements, and all communication logs.

- Comprehensive Coverage: Emphasize the need to preserve any item that might lead to the discovery of admissible evidence in a potential lawsuit.

Legal Importance

- Anticipating Litigation: By making this demand, you signal the possibility of litigation, underscoring the seriousness of the claim.

- Avoiding Spoliation: This helps prevent the destruction or loss of crucial evidence, known as spoliation, which can critically impact a case.

Strategic Considerations

- Early Preservation: Making this demand early ensures that evidence is preserved before it can be lost or destroyed.

- Broad Spectrum: The wide range of requested materials aims to cover all bases, leaving no stone unturned in gathering potential evidence.

- Evidence of Compliance: This request also serves to document the insurer’s obligation to preserve evidence, which can be important if there is a later claim of spoliation.

This demand for the preservation of evidence is a proactive and necessary measure to protect your client’s rights and interests. It serves as a formal notice to the insurance company, ensuring that all relevant evidence is maintained and available for any future legal actions.

15. Documents to Send with Your Demand Letter

When submitting your demand letter for a car accident settlement, including a comprehensive set of documents is crucial. These materials support your claim and provide concrete evidence to back up your assertions. Here’s a checklist of key documents to attach:

Medical and Billing Records

- Medical Reports: Detailed reports of injuries, diagnoses, and treatments.

- Billing Statements: Itemized bills for all medical treatments, including hospital stays, doctor visits, physical therapy, and any other related expenses.

Crash Report

- Official Report: Include a copy of the police or accident report, which provides an authoritative account of the accident’s circumstances.

Photographic Evidence

- Accident Scene Photos: Images of the accident location, showing road conditions, signage, and other relevant details.

- Vehicle Damage Photos: Pictures of damage to all vehicles involved.

- Injury Photos: Visual documentation of injuries sustained in the accident.

Witness Statements

- Statements and Contacts: Written or recorded accounts from witnesses, along with their contact information for potential follow-up or testimony.

Other Supporting Materials

- Repair Estimates: Estimates or receipts for vehicle repairs.

- Pay Stubs or Income Statements: If claiming lost wages, include documentation showing your typical earnings.

- Future Treatment Estimates: If applicable, provide estimates for future medical treatments or rehabilitative services.

- Visual Aids: Include any diagrams, maps, or other visual representations used to explain the accident or injuries.

- Preservation of Evidence Notice: A copy of the notice sent to the insurance company demanding the preservation of evidence.

These documents collectively provide a robust foundation for your claim, illustrating the extent of your injuries, the circumstances of the accident, and the financial impact it has had on your life. By meticulously compiling and including these materials with your demand letter, you enhance the credibility of your claim and facilitate the insurance adjuster’s evaluation process.

Other Sections to Consider Adding to Your Demand Letter

When drafting your demand letter for a car accident settlement in Texas, two crucial sections you may want to include are Lost Wages and Pain and Suffering. These sections can significantly bolster your claim by providing a comprehensive view of the accident’s impact on your life.

Lost Wages

Lost wages are a critical component of many car accident claims. To substantiate this claim, it’s important to provide clear and detailed documentation.

- Employer Documentation: An effective way to prove lost wages is through a form completed by your employer. This document should detail the time you had to take off from work due to the accident and the corresponding amount of wages lost.

- Pay Stubs or Earnings Statements: Include copies of your pay stubs or earnings statements from before and after the accident. This helps to demonstrate the difference in your earnings as a direct result of the accident.

- Self-Employment Records: If you are self-employed, provide records such as invoices, billing statements, or correspondence that show a reduction in business activity and income due to the accident.

The inclusion of these documents in your demand letter can effectively support your claim for lost wages, making it a tangible and quantifiable loss that the insurance company should consider.

Pain and Suffering

Pain and suffering can be more challenging to quantify but are no less important.

- Real-Life Impact: Instead of using a specific formula, focus on describing how the pain and suffering from the accident have affected your daily life. This might include limitations in your physical activities, ongoing pain, emotional distress, and how these changes have impacted your relationships, hobbies, and overall quality of life.

- Compelling Narratives: Share specific instances or examples that clearly illustrate the pain and suffering you’ve endured. This personalizes your claim and can make a powerful impact on the adjuster reviewing your case.

- Consideration of Inclusion: Unless there are particularly compelling examples of how your life has been affected, it might be advisable to omit this section from your demand letter. However, for guidance on how to calculate and articulate pain and suffering in your claim, I recommend visiting my blog post: Calculating Pain and Suffering in Texas Car Accident Claims.

Incorporating these sections into your demand letter can provide a more holistic view of the consequences of the accident. It not only covers the financial aspect but also addresses the emotional and physical toll, which can be equally, if not more, devastating.

Conclusion

In summary, crafting an effective personal injury demand letter for a car accident settlement in Texas involves several key components, each playing a crucial role in presenting a strong and convincing case.

Here are the main takeaways to remember:

- Clear and Detailed Information: Start with precise contact, mailing, and claim information.

- Factual Background: Provide an unembellished account of the accident.

- Visual Aids: Utilize photographs, diagrams, and maps to reinforce your narrative.

- Demonstration of Negligence: Clearly articulate how the at-fault driver violated standard care.

- Evidence of Liability: Cite specific traffic safety statutes the at-fault driver violated.

- Medical Treatment and Expenses: Present a detailed account of your medical expenses and treatments, especially in high-cost cases.

- At-Fault Driver’s Exposure: Outline the risks and liabilities faced by the at-fault driver.

- Insurance Company’s Exposure: Discuss the legal and financial risks for the insurer, including precedents set by key legal cases.

- Settlement Offer: Make a strategic offer to settle the claim, considering policy limits and the specifics of your case.

- Preservation of Evidence: Demand the retention of all relevant evidence related to the accident.

- Supporting Documentation: Attach comprehensive supporting documents, including medical records, photographs, witness statements, and the accident report.

Remember, your demand letter is not just a request for compensation; it’s a well-supported argument that outlines the basis for your claim. By following these steps, you’re positioning yourself for a successful negotiation, ideally leading to a fair and adequate settlement.