Progressive Car Accident Claims & Settlements Guide (2024)

January 1, 2024

In this post, you’ll learn everything you need to know about Progressive Car Accident Claims and Settlements in Texas.

Here is an overview:

- Key Takeaways

- About Progressive Insurance

- Progressive’s Auto Insurance Claims Process

- How to Negotiate with Progressive Insurance After a Car Accident

- Examples of Verdicts and Settlements in Progressive Personal Injury Cases

- $19,000 Settlement in Lawsuit Against Geico’s Insured in Houston, Texas

- Minor Injury Settlements

- Serious Injury Cases

- Disputed Liability Cases

- Fatal Accident Claims

- Court Verdicts vs. Settlements

- Controversies Involving Progressive Insurance

- Litigating Against Progressive Insurance in Texas

Key Takeaways

- Understanding Progressive: Progressive is a major auto insurer known for its digital innovations and distinctive marketing.

- Claims Process: The claims process involves reporting the accident, undergoing inspection and repair options, scheduling repairs, and managing car repairs.

- Negotiation Tactics: Effective negotiation with Progressive requires careful documentation, medical treatment tracking, and legal consultation, especially for fair settlement offers.

- Litigation Challenges: Progressive’s litigious nature and aggressive defense tactics, particularly in cases involving complex claims and Uber coverage, require strategic legal handling.

- Questionable Settlement Terms: Progressive often includes clauses in settlements that can waive other claims, necessitating vigilant legal review.

- Settlement Pressure Tactics: Claimants are often pressured to settle quickly, sometimes before fully understanding their situation.

These takeaways highlight the importance of strategic legal approaches and thorough understanding of insurance policies and practices when dealing with Progressive Insurance claims in Texas.

About Progressive Insurance

The Progressive Corporation, founded in 1937, has grown into a leading figure in the American insurance industry. As of late 2022, it stands as the largest auto insurance carrier in the United States.

With its headquarters in Mayfield Village, Ohio, Progressive offers a diverse range of insurance products, including vehicle, home, life, pet insurance, and more.

Progressive is known for its innovative approaches in the insurance sector. It was the first auto insurance company to introduce a website, enabling customers to purchase policies online. Progressive also pioneered the use of mobile browsers and smartphone apps for policy management.

Progressive’s adaptability extends to its marketing strategies as well, with the company being the first major insurer to offer auto policies via phone and website.

The company’s advertising campaigns are distinctive and memorable, featuring characters like Flo and the Messenger, as well as the more recent inclusion of Jon Hamm in its commercials.

Progressive has also been a forerunner in offering Pay As You Drive insurance, a form of usage-based insurance, under its Snapshot program. This program allows drivers to potentially save on their car insurance by sharing their driving habits.

Progressive’s influence extends beyond insurance, with its involvement in various sponsorships and corporate social responsibility initiatives. It is a corporation that has not only left a significant mark in the insurance industry but also in popular culture and technological innovation.

Progressive’s Auto Insurance Claims Process

When filing an auto insurance claim with Progressive, the process usually involves several key steps:

- Report the Accident: This can be done via Progressive’s online portal, their mobile app, or by calling their claims center. You will need to provide basic information about the accident, including the date, location, and details about the other party involved, if applicable.

- Claims Representative Assignment: After reporting the accident, a claims representative will be assigned to your case. This representative will be your main point of contact throughout the claims process.

- Damage Assessment and Documentation: You may need to submit additional documentation, such as photographs of the damage, a copy of the police report, and details of any injuries sustained. Progressive may also arrange for an inspection of your vehicle to assess the damage.

- Claim Evaluation: The claims representative will review all the information and documentation to determine liability and the extent of the coverage. This step may involve discussions with you, any witnesses, and possibly the other party involved in the accident.

- Settlement Offer and Negotiation: Once the evaluation is complete, Progressive will present a settlement offer. You have the option to accept this offer or negotiate if you feel it does not adequately cover your damages and losses.

- Claim Resolution: After agreeing on a settlement, Progressive will process the payment, which may include direct payment to repair facilities or medical providers, or a reimbursement to you for out-of-pocket expenses.

- Tracking Your Claim: Progressive typically allows you to track the status of your claim online or through their mobile app, providing transparency and updates throughout the process.

If you were injured in a car accident, you may want to consider filing a claim for bodily injuries with Progressive in addition to your property damage claim. An experienced Dallas car accident lawyer can help guide you through this process.

For the most accurate and detailed description of the claims process, it is best to visit Progressive’s official website, particularly their sections dedicated to claims and FAQs.

How to Negotiate with Progressive Insurance After a Car Accident

Negotiating with Progressive Insurance following a car accident can be a critical step in ensuring you receive fair compensation for your damages and injuries. Here are some key steps and tips to consider during the negotiation process:

- Don’t Give a Recorded Statement: It’s important not to give a recorded statement to Progressive’s claims adjuster before you fully understand the extent of your damages and consult with a legal professional. Recorded statements can sometimes be used to minimize your claim.

- Gather Comprehensive Evidence: Collect as much evidence as possible from the accident scene. This includes photographs of the vehicles and the accident location, contact information of witnesses, and a copy of the police report.

- Seek Medical Attention Immediately: Even if you feel fine, it’s crucial to seek medical attention right away. Some injuries are not immediately apparent. Document all visits, treatments, and diagnoses, as these medical records will be vital for your claim.

- Maintain Consistent Medical Treatment: Follow through with all prescribed treatments and attend all medical appointments. Gaps in treatment can be used by insurance companies to argue that your injuries are not as serious as claimed.

- Obtain a Copy of the Crash Report: The crash report provides an official account of the accident, which can be critical in establishing fault and the details of the incident.

- Photograph Everything: Take photos of your injuries, damage to your vehicle, and any other relevant evidence. Visual documentation can significantly strengthen your case.

- Do Not Accept the First Settlement Offer: Initial offers from insurance companies are often lower than what you may actually be entitled to. It’s important to review any offer carefully and consult with an attorney.

- Hire a Personal Injury Lawyer: Consider hiring a personal injury lawyer to represent you. They can handle negotiations on your behalf, ensuring that your rights are protected and that you receive a fair settlement.

- Use Resources for Demand Letters: Utilize guides like the one provided by Wagoner Law Firm for writing effective demand letters for car accident settlements. This can help in clearly presenting your case and the compensation you are seeking.

- Understand Your Policy and Rights: Be familiar with the details of your insurance policy and your rights under it. This knowledge will be crucial during negotiations.

For further guidance, particularly on writing a demand letter, refer to the article provided by Wagoner Law Firm: How to Write a Demand Letter for a Car Accident Settlement in Texas. This resource can offer valuable insights into structuring your communication with Progressive.

Examples of Verdicts and Settlements in Progressive Personal Injury Cases

Understanding the outcomes of previous personal injury cases involving Progressive Insurance can provide valuable insights into how the company handles claims and the potential compensation one might expect. Here are some examples of verdicts and settlements in cases where Progressive was the insurer:

$19,000 Settlement in Lawsuit Against Geico’s Insured in Houston, Texas

- A female plaintiff filed a lawsuit seeking benefits under her Geico uninsured motorist (UM/UIM) coverage after being injured in a hit-and-run car accident.

- The collision occurred when the plaintiff’s vehicle was rear-ended by an unknown driver on I-45 in Houston, Texas, causing neck and back injuries.

- The driver fled the scene without providing information.

- Despite submitting a proof of loss, Geico denied the plaintiff’s claim for the $30,000 policy limit.

- The parties ultimately settled the dispute for $19,000.

- See Fowler vs. Geico, No. 2017-26367, in the 234th Judicial District Court of Harris County, Texas (Feb. 13, 2020).

Here is a copy of the settlement agreement between Progressive’s in-house law firm and the plaintiff:

Minor Injury Settlements

In cases where injuries were minor and recovery was quick, settlements have generally been modest, covering medical expenses and minor damages. For instance, settlements in the range of $10,000 to $15,000 are not uncommon for minor whiplash or soft tissue injuries.

Serious Injury Cases

In more serious cases, where the injuries have long-term or permanent effects, settlements have been significantly higher. For example, cases involving spinal injuries or severe fractures have seen settlements in the six-figure and million-dollar range, reflecting the higher medical costs and potential for ongoing care, pain and suffering, loss of enjoyment of life, or loss of income.

Disputed Liability Cases

In situations where liability was in question, Progressive has been known to contest claims more vigorously. However, successful plaintiffs in such cases have still managed to secure fair compensation through negotiation or litigation. Settlements in these cases can vary widely based on the specifics of the accident and injuries.

Fatal Accident Claims

In the tragic instances of fatal accidents, the settlements typically consider the loss of life, loss of consortium for family members, and potential future earnings. These cases often result in substantial settlements or verdicts, often reaching into the millions.

Policy Limits and Underinsured Motorist Claims

There have been instances where settlements were capped by the policy limits. In cases where damages exceed the at-fault driver’s policy limits, underinsured motorist coverage can play a crucial role. These settlements often depend on the victim’s own policy limits.

Court Verdicts vs. Settlements

While many cases are settled out of court, some do go to trial. Verdicts can sometimes be higher than settlement offers, but they also carry the risk of uncertainty and extended legal proceedings.

It’s important to note that each case is unique, and the outcome depends on various factors, including the severity of injuries, the clarity of liability, the jurisdiction, and the skill of the legal representation. These examples are illustrative and should not be taken as guarantees of similar outcomes in future cases.

Controversies Involving Progressive Insurance

Over the years, Progressive Insurance has faced several controversies, especially in the realm of auto insurance claims. Understanding these controversies is important for anyone dealing with a claim through Progressive. Some notable controversies include:

- Diminished Value Claims: In 2002, Progressive settled a class-action lawsuit in Georgia regarding diminished value claims. Policyholders argued that Progressive failed to compensate for the reduced value of their vehicles after repairs.

- Invasion of Privacy Accusations: In 2007, Progressive faced backlash when it was revealed that they hired private investigators to infiltrate a church group to collect information on litigants seeking redress from the company. This led to a lawsuit over invasion of privacy and fraud.

- Disputes Over Repair Practices: In 2009, Progressive was sued for allegedly using unlicensed body shops for vehicle repairs, which policyholders claimed led to substandard repairs. The court ruled in favor of Progressive on two counts, while the other four were dropped pending appeal.

- Advertising Controversies: Progressive has also faced issues related to its advertising. For instance, there was a dispute with another major insurance company over comparative advertising claims, leading to recommendations for Progressive to discontinue certain advertising practices.

- Handling of Claims in High-Profile Cases: One of the most publicized controversies involved the handling of a claim filed by the family of Kaitlynn Fisher, who died in a car accident in 2012. Progressive’s handling of the claim and their role in the subsequent trial attracted widespread criticism and raised questions about the company’s practices in dealing with serious claims.

- Allegations of Policy Cancellation: There have been instances where Progressive was accused of cancelling policies of individuals who were involved in accidents or who filed claims, although these instances appear to be relatively isolated and not indicative of widespread company policy.

These controversies highlight the complexities and challenges that can arise when dealing with large insurance companies. They underscore the importance of understanding your rights as a policyholder and, where necessary, seeking legal assistance to navigate the claims process effectively.

Litigating Against Progressive Insurance in Texas

As an experienced personal injury lawyer in Texas, my encounters with Progressive Insurance have revealed their notably litigious nature, especially in defending against personal injury lawsuits from car accidents. Here are key insights from my practice:

- Progressive’s Litigious Approach: Progressive often refuses to settle claims easily, even in clear-cut cases. For example, they declined a pre-suit settlement in a high-speed crash case, despite the at-fault driver’s policy limits being exceeded by medical bills.

- Challenging Claims Aggressively: In the mentioned case, Progressive, insuring both the at-fault driver and the plaintiff’s UIM policy, only settled the liability claim after legal intervention but contested the UIM claim. They aggressively disputed medical costs and treatment necessity, even implying the plaintiff exaggerated injuries.

- Questionable Provisions in Settlements: Progressive’s tactics include inserting clauses in settlements that could potentially waive other legitimate claims. Vigilance and legal expertise are crucial to counter these tactics.

- Settlement Pressure Tactics: Progressive is known for pressuring claimants to settle prematurely, often before they can fully assess their situation or consult a lawyer.

- Typical Policy Limits: Progressive’s typical liability policies are at the minimum $30K/$60K limits. Their UM/UIM coverage is usually capped at $100,000 per person.

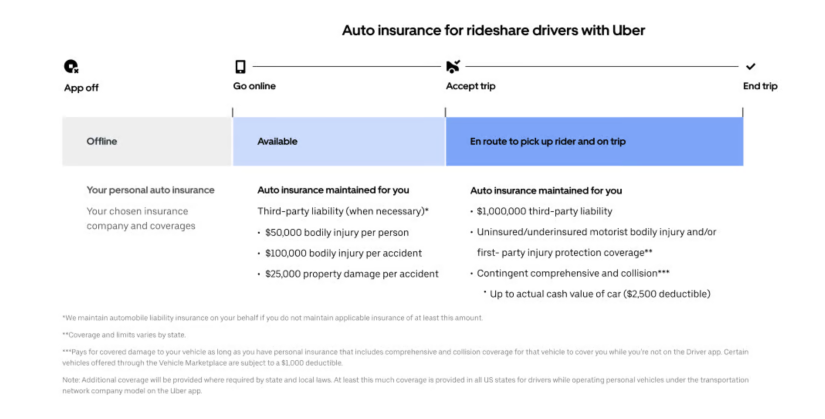

- Uber Coverage: In Texas car accidents involving Uber, Progressive’s coverage varies based on the driver’s status at the time of the accident. When the Uber driver is available for trips but not yet engaged in a ride, the coverage limits are $50K/$100K for third-party liability. However, once the driver is en route to pick up a rider or during the trip, the coverage significantly increases to $1,000,000 for accidents caused by the Uber driver. This distinction in coverage levels is a crucial aspect for personal injury claims involving Uber drivers insured by Progressive.

Litigating against Progressive demands a strategic and informed approach, given their propensity for stringent defense and complex settlement terms. Understanding their policies and tactics is essential for effectively advocating for clients’ rights and securing fair compensation.

In conclusion, while Progressive is a major player in the Texas insurance market, navigating claims with them requires an understanding of their specific practices and a readiness to advocate strongly on behalf of the claimant. Legal counsel experienced in dealing with Progressive can provide invaluable assistance in this process.